What is EIN? How Long Does it Take to Get an EIN Without an SSN?

Many non-US citizens have little or no information about getting an Employer Identification Number (EIN). Most people will give incomplete or false information because they try to sell something or are misinformed.

In this blog, we provide an insight into what EIN is and how long it will take you without an SSN.

Let's start with the basics.

What is EIN?

EIN is a nine-digit employer identification number assigned to a company for easy identification by Internal Service Revenue (IRS). EIN is used just like Social Security Number is used to identify a person's residency in a country. Business owners can directly apply for EIN through IRS and use it to report for taxes.

EIN is also called Federal Tax Identification Number, and it includes where your company is registered. You can apply for EIN by phone, email, fax, or online.

Who Need an EIN?

You need an EIN if you have the following:

- You Have employees

- Operate as a partnership or corporation

- You need to file tax returns

- Have a Keogh plan

- You're involved in organizations like non-profit organizations

- Withhold tax from wages of non-US residents

Business Entities that Need to Apply EIN Include

- Estates

- Limited liability companies

- Sole proprietorship

- Partnerships

- S corporations

- Non-profit organizations

- Trusts

- Government agencies

How to Apply for EIN

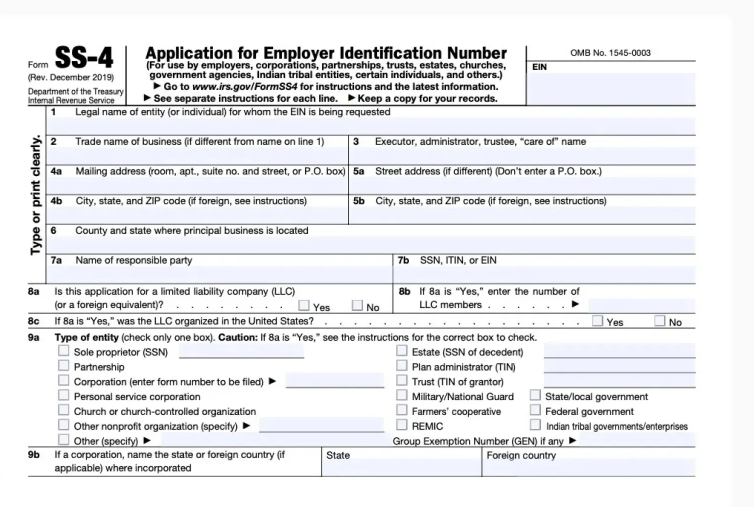

Applying for EIN is free and easy; you can make an application through your phone if you aren't in the US and want to do business in the country. As an applicant, you must fill out SS-4, which you will find on the IRS website. In your application, you need to include information such as the company's principal officer name, trustor owner, or owner.

Here is the information that you must include in the form

- Type of entity

- The reason for applying to a new company

- The acquisition date

- The principal business industry

- For you to apply for an EIN online, your company must be located in the US territory.

How Long Will It Take to Get Your EIN Without an SSN?

It's possible to apply for EIN even if you don't have an SSN. There are two options for applying for EIN. You can choose fax or mailing. It takes between two and three months to get your EIN. But you can call the IRS and inquire about the EIN verification letter.

IRS should fax or mail you an EIN confirmation letter, which is sent to the address you wrote in 4a and 4b. However, if you have an approved fax and didn't receive an EIN confirmation letter, you can get an EIN verification letter as you wait for the EIN confirmation letter.

The EIN verification letter serves the same purpose as the EIN confirmation letter, which shows that IRS approved your LLC EIN.

After getting an EIN, you can now open a non-US resident LLC bank account.

Remember, it may take almost four months before you receive your EIN confirmation letter in your mail. So, you should avoid re-sending the SS4 to the IRS since it can create confusion and more delay. Additionally, the IRS is busy during January, March, April, October, and December, so if you apply during these months, be extra patient.

Form Your Company From Anywhere in the World with Foundeck Today

Foundeck offers a range of fast and efficient online company formation services, allowing you to register a business structure of your choice quickly from any where around the world. To get started, kindly contact us here.

9 Facts About EIN

Many people get confused when applying for EIN because of some wrong circulation myths about EIN.

1. EIN is entirely free

You don't have to pay any cost to get EIN, unless you're hiring someone to get it for you. Although you can hire someone to get the EIN for you, getting it yourself is easy.

2. You must be a US citizen or resident to get EIN

This myth is false. You can get EIN even if you aren't a US citizen and don't reside in America. There is no residency requirement to form an LLC; the same applies. You don't need to be a citizen or resident to get your EIN.

3.You must have an SSN to acquire EIN

This is also false. It's not a must to have a social security number to get an EIN. You just need to send SS-4 to IRIS through mail or fax.

4. You need an individual taxpayer identification number (ITIN) to obtain an EIN

You don't need an ITIN to get an EIN unless you want to file a US tax return. It's impossible to get an ITIN before getting an LLC because you need to generate income and then file for tax after a year, around April 15. So when you will be returning your tax, you will apply for ITIN.

5. You need a designee to get EIN

you don't need an appointee to apply for EIN unless you're paying someone.

6. Must you get an accountant or advocate to get EIN?

It's not a must to hire an advocate or attorney to help you EIN; just mail form SS-4 to the IRS.

7. Can I get EIN online?

Without an SSN or ITIN, you cannot get an EIN online, and if you start, you will get an error message towards the end of your application if you're a foreigner.

8. You must call the IRS to get an EIN

although the IRS has an international EIN department with the number 1-267-941-1099, you can't call this number if you have a US LLC to get your EIN. The number is for companies formed outside the US and not within the US and owned by non-US citizens.

9. Must I have a US address to get an EIN?

No, you don't need a United States office or mailing address to obtain an EIN. As long as you have a mailing address, either US or non-US, you can get an EIN from the IRS.

How to Complete Form SS-4 (EIN Application)

Start by getting the SS4 form, then fill it out by hand and sign or type using your computer. When filling out the form, it's advisable to use uppercase letters. On the form in the upper right part of the EIN box, don't fill it. IRS will enter your EIN once your application is approved.

Here is how you should fill out your SS4:

1.The legal name of your business (LLC)

Enter your LLC name as listed in the certificate of formation.

2. Trade name of your business

Most non-US residents don't have trade names if you have to enter them under a fictitious name, DBA name, or trade name.

3. Executor trustee administrator care of Name

Don't fill this field; it's not necessary when applying for EIN

4a. and 4b mailing address

You should enter the mailing address where IRS will send tax document reminders. The address can be US or non-US address you filled in on your LLC forms. Ensure the mailing address is reliable, and you will use it for filing tax returns. Having a US address may be advantageous when you want to open a US bank account, since banks use the address on the EIN confirmation letter as proof of US address.

5a. and 5b street address

Leave this field

6. County and State where LLC is located

Enter the county where your LLC is located in the United States.

7a. Name of the responsible party

Here, enter the Name of the LLC owner

7b. SSN EIN or ITIN

This section confuses most applicants who don't have ITIN or SSN and are seeking EIN. However, you should enter "foreign."

8. Is the application for LLC?

Fill in "yes."

Then, enter the number of LLC member

Single member: enter 1

Multi-member: enter all members of your LLC or the number of companies owning the LLC

Is LLC organized in the US: Check off, yes. Your LLC is foreign-owned but is still organized in the US

9. Type of entity

Before filling this section, it's advisable to discuss it with an accountant because taxation is complicated in the US for residents and non-US.

State and foreign country

State: enter where your LLC was formed and use full names

Foreign country: leave this blank

10. Reason for applying

You should select started a new business and specify the company your LLC will focus on

11. Date business started

Enter the month, day, and year of your LLC approval by the State. Confirm the dates with approved articles of your organization. Example of the date March 21, 2023

12. Closing month of the year

Many non-US business owners run their taxes on a calendar year, so enter December.

13. Employees

If you don't have US employees, enter '0'. However, if you have, you must withhold their income taxes and Medicare taxes, pay their social security, and on their wages, pay unemployment taxes.

14. Employment tax liability

This section may not be applicable to most foreigners, so leave the box unchecked.

15. First-date annuities or wages are paid.

This section may not be applicable for most foreigners, but if you have US employees, enter the date you began paying their wages.

16. Principal activity

Enter what you entered on number 10

17. Explain #16

Give details on your LLC business activity. The IRS needs to know what your product is, the services you're offering, and the merchandise you are selling.

18. Applied EIN before?

If you've applied for EIN before, you can say YES, and if you haven't, select NO.

Conclusion

Although there are many myths revolving around getting the EIN, you now know you can get it without an SSN. It's an easy process you can do by yourself or hire a licencensed online agent to do it for you. To get EIN, you don't need a US address or to be in the US. After the EIN application, it takes between two weeks to three months to get an EIN letter of confirmation. Have any question on EIN or company formation in the US, kindly reach out for clarity today.